How Debt Collection Works — Explained Clearly

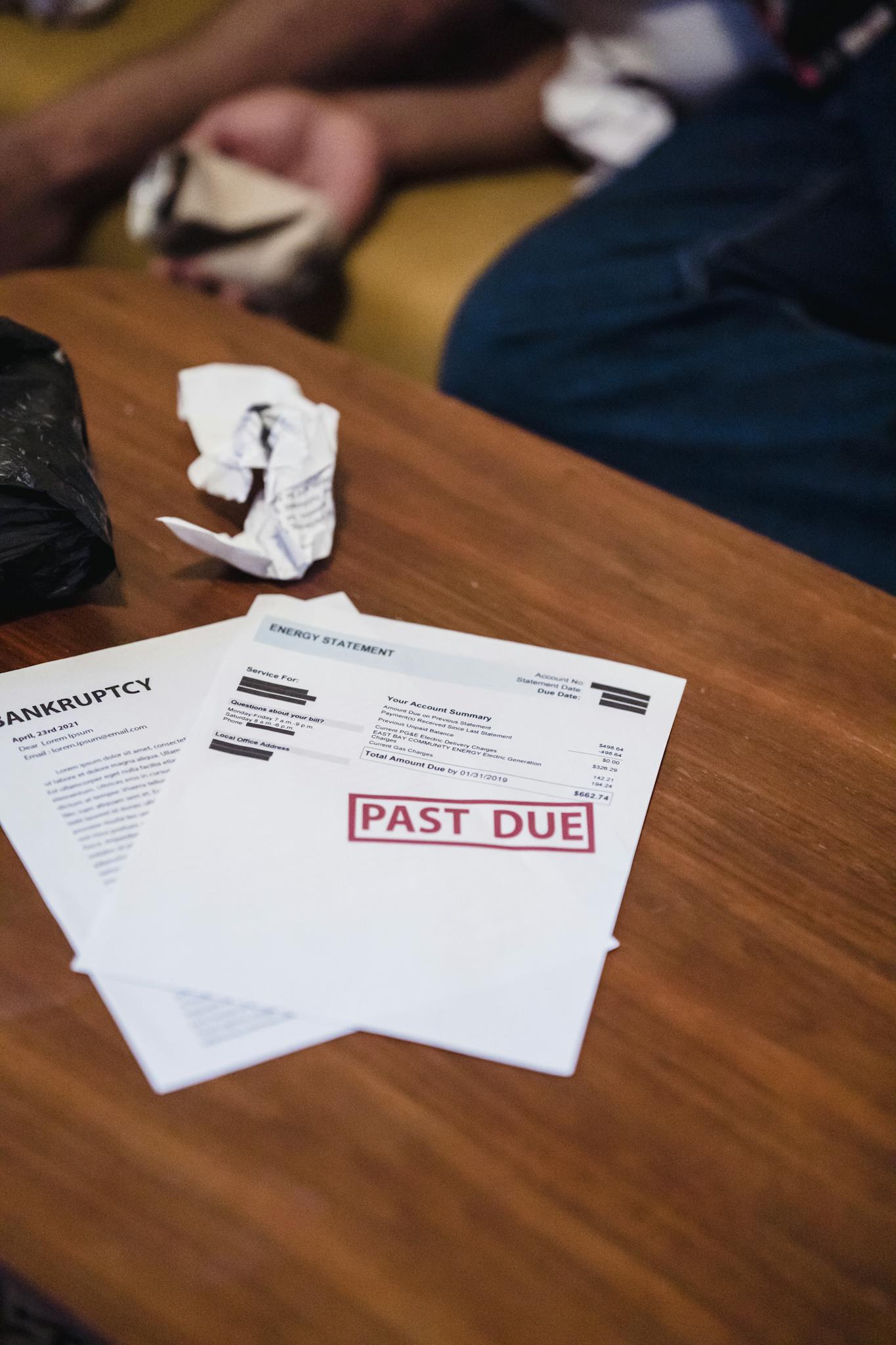

Learn how medical, consumer, and business debt is handled by collection agencies—what to expect, how to protect your rights, and how to move forward with confidence.

Know the Process

We break down every step of how debt collectors work—whether it’s medical, consumer, or business debt—so you’re never caught off guard.

Understanding Debt Collection Efforts

We provide trustworthy information about the debt collection process.

User-Friendly Resources. Consumer Debt Collection

Up-to-Date Information.

Business to Consumer

Supportive Community. Commercial Debt Collection

Understand the Types of Debt Collection

Consumer Debt Collection Explained

Learn how agencies handle everyday debt like credit cards, utilities, and personal loans. Understand your rights and what steps collectors can—and can’t—take.

Consumer Debt Collection Explained

Learn how agencies handle everyday debt like credit cards, utilities, and personal loans. Understand your rights and what steps collectors can—and can’t—take.

How Medical Debt Goes to Collections

Unpaid medical bills can be confusing. Explore how insurance gaps lead to collections, and discover your options for resolution or negotiation.

Quick Facts About Debt in America

From medical bills and personal credit to unpaid business invoices, debt affects nearly every American. These key stats provide helpful context as you learn how collection agencies operate and what your options are.

Clear and accurate guidance.

Advice from industry experts.

Know your legal protections.

Understand your rights and options in debt collection.

Learn how to handle debt collections with confidence and clarity.